On 17 May 2023, the Commission put forward proposals for the most ambitious and comprehensive reform of the EU Customs Union since its establishment in 1968.

Key features of the proposals

The reform responds to the current pressures under which EU Customs operates, including a huge increase in trade volumes, especially in e-commerce, a fast-growing number of EU standards that must be checked at the border, and shifting geopolitical realities and crises.

The measures proposed present a world-leading, data-driven vision for EU Customs, which will massively simplify customs processes for business, especially for the most trustworthy traders. Embracing the digital transformation, the reform will cut down on cumbersome customs procedures, replacing traditional declarations with a smarter, data-led approach to import supervision. At the same time, customs authorities will have the tools and resources they need to properly assess and stop imports which pose real risks to the EU, its citizens and its economy.

A new EU Customs Authority will oversee an EU Customs Data Hub which will act as the engine of the new system. Over time, the Data Hub will replace the existing customs IT infrastructure in EU Member States, saving them up to €2 billion a year in operating costs. The new Authority will also help deliver on an improved EU approach to risk management and customs checks.

Overall, the new framework will make EU Customs fit for a greener, more digital era and contribute to a safer and more competitive Single Market. It simplifies and rationalises customs reporting requirements for traders, for example by reducing the time needed to complete import processes and by providing one single EU interface and facilitating data re-use. In this way, it helps deliver on President von der Leyen’s aim to reduce such burdens by 25%, without undermining the related policy objectives.

The three pillars of EU Customs Reform

A new partnership with business

In the reformed EU Customs Union, businesses that want to bring goods into the EU will be able to log all the information on their products and supply chains into a single online environment: the new EU Customs Data Hub. This cutting-edge technology will compile the data provided by business and – via machine learning, artificial intelligence and human intervention – provide authorities with a 360-degree overview of supply chains and the movement of goods.

At the same time, businesses will only need to interact with one single portal when submitting their customs information and will only have to submit data once for multiple consignments. In some cases where business processes and supply chains are completely transparent, the most trusted traders (‘Trust and Check’ traders) will be able to release their goods into circulation into the EU without any active customs intervention at all. The Trust & Check category strengthens the already existing Authorised Economic Operators (AEO) programme for trusted traders.

This new partnership with business is a world-first. It is a powerful new tool to support EU businesses, trade and the EU’s open strategic autonomy. The EU Customs Data Hub will allow goods to be imported into the EU with minimum customs intervention, without compromising on safety, security or anti-fraud requirements.

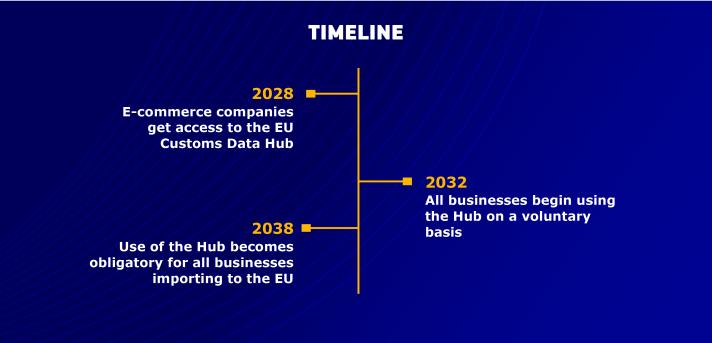

Under the proposals, the Data Hub will open for e-commerce consignments in 2028, followed (on a voluntary basis) by other importers in 2032, leading to immediate benefits and simplifications. Trust & Check traders will also be able to clear all of their imports with the customs authorities of the Member State in which they are based, no matter where the goods enter the EU. A review in 2035 will assess whether this possibility can be extended to all traders when the Hub becomes mandatory as from 2038.

A smarter approach to customs checks

The proposed new system will give customs authorities a bird’s-eye view of the supply chains and production processes of goods entering the EU. All Member States will have access to real-time data and will be able to pool information to respond more quickly, consistently and effectively to risks.

Artificial intelligence will be used to analyse and monitor the data and to predict problems before the goods have even started their journey to the EU. This will allow EU customs authorities to focus their efforts and resources where they are needed most: to stop unsafe or illegal goods from entering the Union and to uphold the growing number of EU laws that ban certain goods that go against common EU values – for example in the field of climate change, deforestation, forced labour, to give just a few examples. It will also help to ensure proper collection of duties and taxes, to the benefit of national and EU budgets.

To help Member States prioritise the right risks and coordinate their checks and inspections – especially during times of crisis – information and expertise will be pooled and assessed at EU level via the new EU Customs Authority acting on the data provided through the EU Customs Data Hub. The new regime will substantially improve cooperation between customs and market surveillance and law enforcement authorities at EU and national level, including through information sharing via the Customs Data Hub.

A more modern approach to e-commerce

Today’s reform will make online platforms key actors in ensuring that goods sold online into the EU comply with all customs obligations. This is a major departure from the current customs system, which puts the responsibility on the individual consumer and carriers. Platforms will be responsible for ensuring that customs duties and VAT are paid at purchase, so consumers will no longer be hit with hidden charges or unexpected paperwork when the parcel arrives. With online platforms as the official importers, EU consumers can be reassured that all duties have been paid and that their purchases are safe and in line with EU environmental, safety and ethical standards.

At the same time, the reform abolishes the current threshold whereby goods valued at less than €150 are exempt from customs duty, which is heavily exploited by fraudsters. Up to 65% of such parcels entering the EU are currently undervalued, to avoid customs duties on import.

The reform also simplifies customs duty calculation for the most common low-value goods bought from outside the EU, reducing the thousands of possible customs duty categories down to only four. This will make it much easier to calculate customs duties for small parcels, helping platforms and customs authorities alike to better manage the one billion e-commerce purchases entering the EU each year. It will also remove the potential for fraud. The new, tailor-made e-commerce regime is expected to bring additional customs revenues to the tune of €1 billion per year.